The Grubhub for Restaurants blog

Subscribe for insights, tips and expert advice on growing your business.

Browse by category

Subscribe for restaurant insights

Featured post

How We Serve Restaurants

We serve restaurants. It’s the reason Grubhub exists and it guides everything we do. It’s our commitment to put restaurants first.

Read about our commitmentBeyond the Feed

Da Nonna Rosa's success story

See why 53% of Da Nonna Rosa’s Grubhub orders include promotion redemptions.

Learn how to make the most out of your Grubhub partnership

Visit our Help Center to get more information on how to use Grubhub products to optimize your partnership.

Explore our products

Grubhub Marketplace

List your restaurant on the Grubhub app and website to find new customers.

Join today

Marketing tools

Access powerful marketing and advertising that’s proven to reach new customers and build fans.

Learn more

Private: Virtual Restaurants

Multiply your revenue potential without increasing overhead costs.

Learn moreTech and POS integration

Simplify your operations with robust point-of-sale (POS) and tech integrations.

Learn more

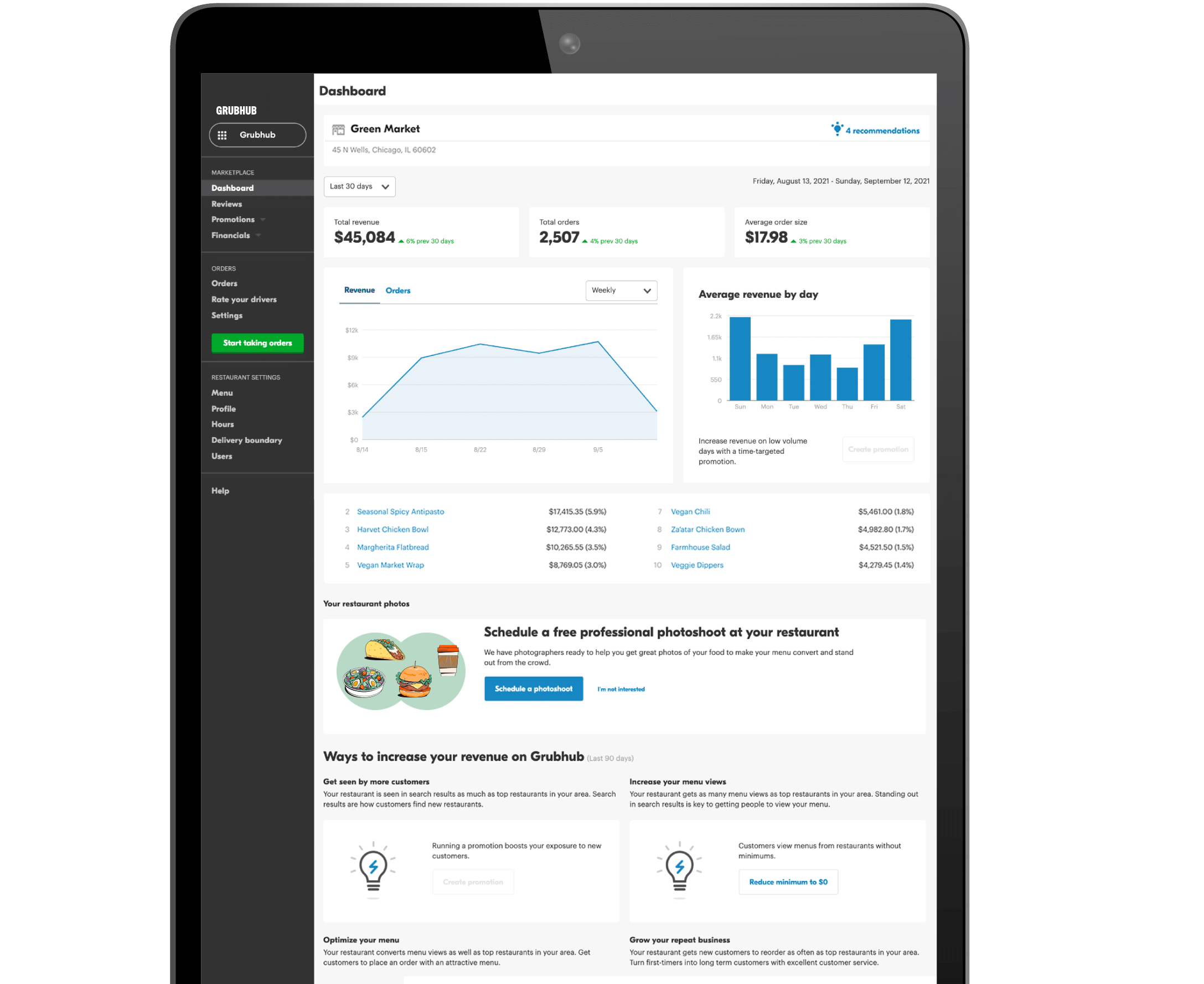

Merchant Portal

Manage everything Grubhub in one place through the Grubhub for Restaurants portal.

Get startedJoin Grubhub Marketplace and start reaching new diners today.

Don’t leave money on the table

The faster you partner with Grubhub, the faster your business can grow.

Join Grubhub Marketplace and get access to all the benefits that go with it. All fields required.

Already have an account? Sign in

Don't miss out - drive higher ROI for your Restaurant!

Nearly 9 out of 10 restaurant owners surveyed agree that Grubhub delivers a high ROI to their business - higher than the competition average*

Thrive on your own terms with flexible pricing and marketing rates as low as 5%.

*Grubhub Restaurant Intelligence Technomic Report 2022